Payments and Invoices

Overview

Bid Bot uses an invoice-based payment system. Invoices are generated at the end of each month based on your usage and subscription. This guide explains how payments work, how to view invoices, and how to manage your billing.

Prerequisites

- A Bid Bot account

- Active subscription or usage that generates charges

- Organisation membership (for organisation billing)

How Payments Work

Invoice-Based Billing

Bid Bot uses an invoice-based billing system:

- Monthly Invoices: Invoices are generated at the end of each month

- Usage-Based: Charges are based on your actual usage

- Automatic Generation: Invoices are generated automatically

- Payment Terms: Standard payment terms apply

What’s Included in Invoices

Monthly invoices include:

- Token Usage: Charges for tokens/credits used during the month

- Subscription Fees: Monthly subscription charges (if applicable)

- Add-Ons: Charges for any add-ons or additional features

- Discounts: Any discounts applied to your account

Invoice Generation

Invoices are generated:

- End of Month: At the end of each calendar month

- Automatic: Generated automatically by Bid Bot

- All Usage: Includes all usage from the month

- Immediately Available: Available for download immediately after generation

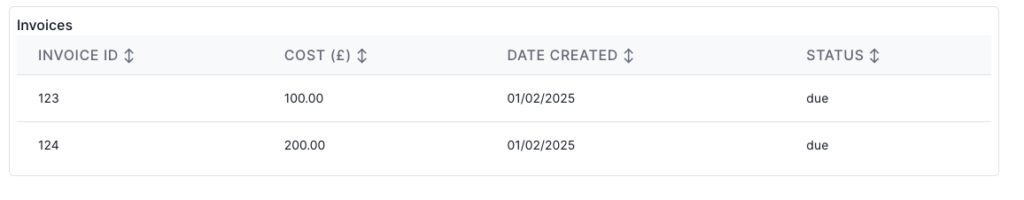

Viewing Invoices

From Profile Page

- Navigate to Profile from the sidebar menu

- Scroll to the Invoices section

- View the list of all invoices

- See invoice details:

From Organisation Page

If you’re part of an organisation:

- Navigate to Organisation from the sidebar menu

- Scroll to the Invoices section

- View organisation invoices

- See organisation billing details

Invoice Details

Each invoice shows:

- Invoice ID: Unique identifier for the invoice

- Amount: Total amount due (formatted as currency)

- Date Created: When the invoice was generated

- Due Date: Date when payment is due

- Paid Date: Date when payment was received (if paid)

- Status: Payment status (Paid or Due)

Downloading Invoices

Note: Invoice download functionality may vary depending on your plan and organisation settings.

Viewing Invoice Details

- Navigate to Profile or Organisation

- Go to the Invoices section

- View invoice information:

- Invoice ID

- Amount

- Date created

- Status (Paid/Due)

Invoice Information Available

The invoice table displays:

- Invoice ID: Unique invoice identifier

- Amount: Total amount due (formatted as currency)

- Date Created: When the invoice was generated

- Status: Payment status (Paid or Due)

For detailed invoice breakdowns and PDF downloads: Please contact support or check if your organisation has additional invoice management features enabled.

Understanding Charges

Token Usage Charges

Tokens are used for:

- Report Generation: Generating analysis reports

- AI Features: AI-powered features and suggestions

- Content Generation: Generating suggested paragraphs

- Analysis Operations: Various analysis operations

Charges are based on:

- Tokens Used: Actual tokens consumed during the month

- Pricing Tier: Your pricing tier and rate

- Discounts: Any discounts applied to token usage

Understanding Token Usage

Token Calculation:

Tokens are calculated as: Number of Questions × (Sum of Enabled Features)

Feature Costs:

- Ingredients Report: +1 token per question

- Requirements Report: +1 token per question

- Personas Report: +N tokens per question (N = number of personas)

- Marking Scheme Report: +1 token per question

- Suggested Paragraphs: +1 token per report type when enabled

Token Prediction:

Before generating reports, you can see predicted token usage. This helps you:

- Plan Usage: Plan your token usage for the month

- Budget Management: Manage your token budget effectively

- Optimise Operations: Optimise operations to stay within allocation

- Cost Awareness: Be aware of token costs before operations

Example:

For a bid with 3 questions, generating all reports:

- Ingredients: 3 tokens

- Requirements: 3 tokens

- Personas (3 personas): 9 tokens

- Marking Scheme: 3 tokens

- Suggested Paragraphs: +12 tokens

- Total: 30 tokens

For more detailed information about token management, see the Token Management guide.

Subscription Fees

Monthly subscription fees may include:

- Base Subscription: Base monthly subscription charge

- Feature Access: Access to premium features

- User Limits: Based on the number of users or features

- Add-Ons: Additional subscription add-ons

Discounts

Discounts may be applied for:

- Volume Usage: Higher token usage volumes

- Annual Plans: Annual payment plans

- Promotional Offers: Special promotional offers

- Organisation Discounts: Organisation-level discounts

Invoice Status

Paid Invoices

- Status: Shows as “Paid”

- Payment Date: Date payment was received

- Download: Can still be downloaded for records

Due Invoices

- Status: Shows as “Due”

- Payment Required: Payment is required

- Due Date: Payment due date

- Reminders: Payment reminders may be sent

Payment Methods

Invoice Payment

Invoices are typically paid:

- Bank Transfer: Direct bank transfer

- Credit Card: Credit card payment (if enabled)

- Automated Payment: Automated payment processing

- Check: Check payment (if applicable)

Payment Processing

Payment processing:

- Processing Time: Standard processing times apply

- Confirmation: Payment confirmation may take time

- Updates: Invoice status updates when payment is received

Best Practices

Invoice Management

- Regular Review: Review invoices regularly each month

- View Invoice Details: Check invoice information and status

- Payment Tracking: Track payment status

- Record Keeping: Keep invoice records for accounting (contact support for detailed invoices)

Cost Management

- Monitor Usage: Monitor token usage throughout the month

- Understand Charges: Understand what generates charges

- Optimise Usage: Optimise usage to manage costs

- Use Discounts: Take advantage of available discounts

Organization Billing

- Centralised Billing: Organisation billing is centralised

- Shared Costs: Costs are shared across the organisation

- Admin Access: Organisation admins can view all invoices

- Cost Allocation: Understand how costs are allocated

Troubleshooting

Can’t View Invoices

- Check Permissions: Verify you have permission to view invoices

- Check Organisation: Verify organisation membership if applicable

- Refresh: Refresh the page and try again

- Contact Support: If invoices don’t appear

Invoice Missing

- Wait for Generation: Invoices are generated at the month’s end

- Check Date: Verify invoice date range

- Check Filters: Check if filters are hiding invoices

- Contact Support: If the invoice exists but doesn’t

Can’t View Invoice

- Check Permissions: Verify you can view invoices

- Try Again: Refresh the page if invoices don’t load

- Check Browser: Try a different browser if the page doesn’t load

- Contact Support: If invoices consistently don’t appear or you need PDF copies

Invoice Amount Incorrect

- Check Usage: Verify token usage for the month

- Check Discounts: Verify discounts are applied correctly

- Check Subscription: Verify subscription fees

- Contact Support: If the amount seems incorrect

Payment Issues

- Check Status: Verify invoice payment status

- Check Payment Method: Verify payment method is valid

- Processing Time: Allow time for payment processing

- Contact Support: For payment-related questions

Contact for Billing

For billing questions or issues:

- Support Email: support@bid-bot.co.uk

- Billing Inquiries: Contact support for billing questions

- Payment Issues: Contact support for payment problems

- Invoice Questions: Contact support for invoice questions

Important Notes

Invoice Timing

- End of Month: Invoices generated at month end

- Usage Period: Covers entire calendar month

- Immediate Availability: Available immediately after generation

Payment Terms

- Standard Terms: Standard payment terms apply

- Due Date: Payment due dates are specified on invoices

- Late Payments: Late payment policies may apply

Record Keeping

- View Invoices: Review all invoices regularly

- Keep Records: Keep invoice records for accounting

- Tax Purposes: Invoices may be needed for tax purposes